Indicators on How Does Medigap Works You Need To Know

Wiki Article

Some Of Medigap Benefits

Table of ContentsThe Buzz on What Is MedigapMedigap Benefits Can Be Fun For AnyoneExamine This Report on What Is MedigapExamine This Report on What Is MedigapThe Main Principles Of What Is Medigap

You will certainly require to speak with a certified Medicare agent for pricing and also accessibility. It is highly recommended that you acquire a Medigap plan during your six-month Medigap open enrollment duration which starts the month you turn 65 as well as are signed up in Medicare Component B (Medical Insurance Policy) - How does Medigap works. Throughout that time, you can get any type of Medigap policy marketed in your state, even if you have pre-existing conditions.You could have to buy an extra costly policy later on, or you may not be able to purchase a Medigap policy in all. There is no assurance an insurer will offer you Medigap if you make an application for coverage outside your open registration period. As soon as you have actually chosen which Medigap plan meets your demands, it's time to learn which insurance provider sell Medigap policies in your state.

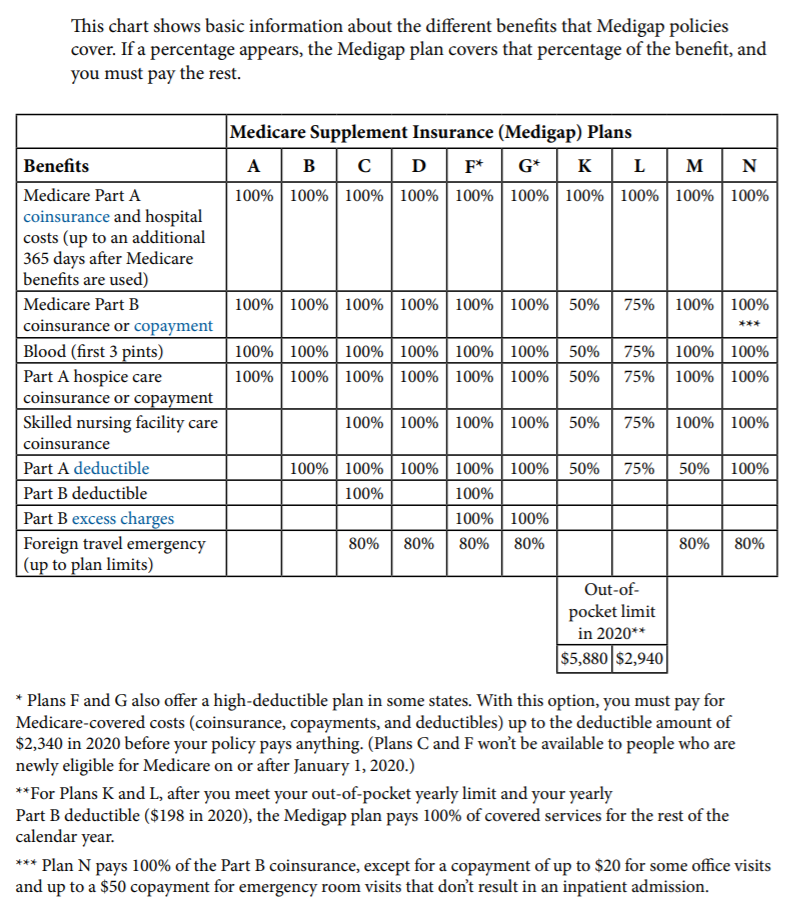

Additionally called Medicare Supplement, Medigap insurance coverage intends help fill out the "voids" in Original Medicare by covering a portion of the out-of-pocket expenses leftover after Medicare Component A as well as B insurance coverage. The exact protections rely on the kind of strategy that is acquired and which specify you live in.

As a whole, Medigap insurance providers function with Original Medicare as well as each strategy kind offers the same benefits, also throughout insurance providers. In the majority of states, Medicare supplement strategies are named A with N. Table of Component, Expand, Collapse When considering Medigap intends, you might additionally check out regarding Medicare Benefit intends Called Medicare Part C.

Medicare supplement insurance, on the other hand, is an addition to enhancement existing Original Medicare initial. Medigap plans just can be combined with Original Medicare as well as not Medicare Benefit. Medigap plans are standardized and also identified by letters, as well as should adhere to government and state guidelines. Typical Medigap insurance coverages include: This is an out-of-pocket expense that patients have to pay each time they get clinical care or a medical thing, such as a prescription.

This is the portion of the expense of a solution that you show Medicare. How does Medigap works. With Part B, Medicare typically pays 80% and the person pays 20%. This is the quantity of money the person should pay out of pocket for health care prior to Medicare starts paying for the costs. With Part A, there's an insurance deductible that puts on each advantage duration for inpatient treatment in a medical facility setup.

Not known Facts About What Is Medigap

If you require health care solutions while taking a trip exterior of the United States, it is necessary to recognize that Original Medicare does not cover emergency medical care services or products beyond the united state Nonetheless, there are some points that Medicare supplement insurance coverage normally does not cover, such as vision or dental care, eyeglasses, listening to aids, private-duty nursing, or lasting treatment.

Medigap intends can assist you reduce your out-of-pocket healthcare expenses so you can get affordable therapy for comprehensive health care throughout your retirement years. Medicare supplement strategies might not be best for every scenario, however comprehending your options will certainly aid you make a decision whether this kind of coverage might aid you handle healthcare costs.

Journalist Philip Moeller is right here to provide the solutions you require on aging and retired life. His weekly column, "Ask Phil," intends to help older Americans and also their families by addressing their healthcare as well as monetary inquiries. Phil is the writer of "Get What's Yours for Medicare," as well as co-author of "Obtain What's Yours: The Revised Keys to Maxing Out Your Social Safety." Send your concerns to Phil; and he will certainly answer as several as he can.

Medigap Benefits Things To Know Before You Get This

The greatest space Related Site is that Component B of Medicare pays just 80 percent of protected expenses. Most likely, more individuals would acquire Medigap plans if they could manage the regular monthly costs. Nearly two-thirds of Medicare enrollees have standard Medicare, with regarding 35 percent of enrollees rather choosing Medicare Benefit strategies.

Unlike various other personal Medicare insurance plans, Medigap strategies are controlled by the states. As well as while the details insurance coverage in the 11 different sorts of plans are dictated by federal guidelines, the prices and schedule of the plans depend upon state rules. Federal regulations do supply ensured problem rights for Medigap buyers when they are new to Medicare and in some conditions when they change between Medicare Advantage and standard Medicare.

Nonetheless, Recommended Reading once the six-month period of government mandated rights has actually passed, state policies take control of identifying the civil liberties individuals have if they want to acquire new Medigap plans. Here, the Kaiser table of state-by-state policies is indispensable. It needs to advice be a compulsory stop for any person thinking about the role of Medigap in their Medicare strategies.

The Of Medigap

I have actually not seen tough information on such conversion experiences, as well as routinely inform visitors to evaluate the marketplace for new policies in their state prior to they change right into or out of a Medigap plan during open enrollment. I presume that worry of a feasible issue makes many Medigap insurance holders resistant to alter.A Medicare Select policy is a Medicare Supplement policy (Strategy A via N) that conditions the payment of advantages, in entire or in part, on using network providers. Network service providers are service providers of healthcare which have actually become part of a composed arrangement with an insurance firm to provide benefits under a Medicare Select policy.

Report this wiki page